The Cold War ended in 1992 with the collapse of the Soviet Union – or so we were told. Given recent events, I am starting to wonder about a totally different view of the world.

Could Putin serve an ironic revenge on the West? If he did, would the real end of the Cold War come in, say, 2028 and not 1992? Revenge is a dish best served cold after all.

The Triumph of the West? (1981-1992)

The Western narrative tells us that the fall of the Soviet Union was caused by political excess and corruption. An ‘evil empire’ that collapsed under its own weight in 1992 – branding that year as the year ‘the West won the Cold War’.

Despite the complexity of the Cold War, the fall of the Soviet Union was triggered by something mundane – bankruptcy. In a coordinated effort, Reagan triggered a Soviet spending problem with the arms race, while the Saudis artificially cratered the oil price, cutting the Soviets off from much needed revenue. It was an effective tactic.

The bankruptcy was obvious enough to every post-Soviet citizen I have befriended. I am sure it was also obvious to Lieutenant Colonel Vladimir Putin of the KGB back in the day. Many Russians still lament the ostensible humiliation of that national bankruptcy. This is a populist sentiment shared by Putin and is used to bolster his plans to restore Russia to an influential geopolitical position.

Political & Energy Transition (2015-2021)

Fast-forward to 2015 and the signature of the Paris Accord. As we all know, the aim of that accord was to reduce carbon emissions to abate climate change. At the time, nations planned an Energy Transition away from coal and oil to renewables or nuclear to occur over a span of decades, with natural gas identified as the key swing energy source to power that transition.

Between 2015 and 2020, oil prices crashed twice (arguably both orchestrated by Saudi Arabia) against a backdrop of Energy Transition and Covid. In combination, these events resulted in a lack of petroleum sector investment, which in turn led to little petroleum reserves replacement by Western nations during that time. This set the stage for the high petroleum prices we now see in 2021.

Over this same 5-year period, Energy Transition proponents pushed for quickened pace of transition – driven by political agendas, Social Media and the notion that a real, economically feasible replacement for natural gas already existed. As the push for quicker transition by Western nations increased (the Great Reset), so too did Western government funding for Energy Transition, including the Biden’s recent $1.2 Trillion- infrastructure bill.

While increasing the pace of Energy Transition is a laudable goal, it is never going to be supportable without a real, economically affordable replacement for natural gas. The hard truth is that such a solution does not yet exist. This may be an unpopular thing to say, but it is a critical admission to maintaining the geopolitical influence of Western democracies over autocratic petroleum producing regimes.

Why? Because the confluence of Western government spending on Energy Transition and Covid and lack of petroleum reserves replacement have created a perfect storm for the West. And a perfectly exploitable opportunity for Putin.

Revenge: A Cold War Dish Best Served Even Colder? (2021-?)

If revenge is a dish best served cold, is the “bankruptcy” of Western governments on the menu at Putin’s Diner?

Recall the Soviets had a spending problem and a revenue problem in 1992. The West seems to sit in an eerily similar situation today. To be clear, it may not involve actual bankruptcy, but it certainly could involve (a) financial hardship in Western nations from energy price inflation and (b) a large leak of Western geopolitical influence to autocratic petroleum countries like Russia and Saudi Arabia.

On the spending side, Western governments have gone wild with Energy Transition and Covid. Between 1992 and 2021, the US National Debt has grown from $4 Trillion to $28 Trillion – with a $6 Trillion increase since 2019. Look Here By contrast, Russia’s hard currency reserves increased from $2 Billion in 1992 to $485 Billion in 2021. Look Here Naturally, these numbers are apples and oranges, but they do demonstrate a governance choice. And the West has a terrible spending problem that shows no sign of slowing down.

The revenue side is a bit more complicated. While Western economies will still generate plenty of revenue – chunks of that revenue will end up in Russian, Saudi Arabian and Chinese pockets, functionally leaving less for the West to work with.

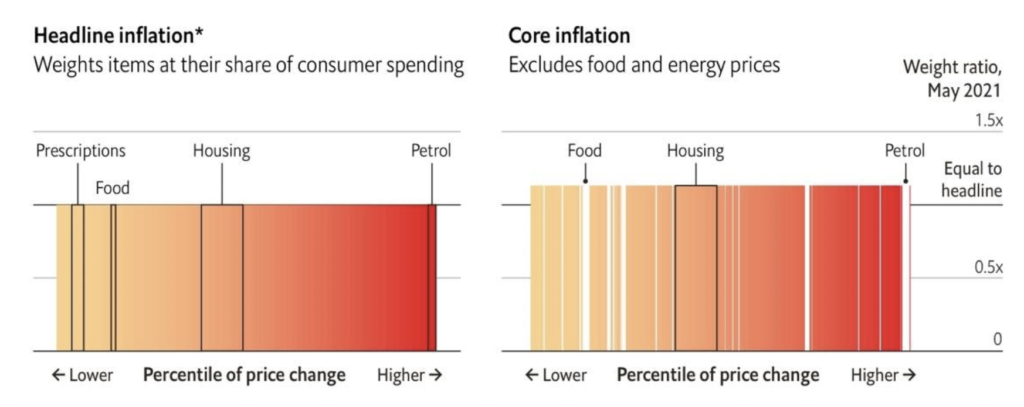

For starters, inflated petroleum prices in the next few years will syphon hundreds of billions of Western dollars to petroleum producing countries like Russia and Saudi Arabia. For a rough proxy, The Economist nicely illustrated the inflation picture with petrol prices this week Look Here :

The questions keep coming. Can Western governments service bloated debt loads with inflated interest rates? What if the lenders (e.g., Western treasury bills) are Russia and Saudi Arabia – or China for that matter? The servicing of Western debt will be yet another transfer of Western wealth.

If you put it all together, the West given Putin a golden opportunity to revenge the Soviet national bankruptcy. If Putin takes up that opportunity, perhaps the real end of the Cold War has yet to come? These are the questions that Western governments should be focusing on – both for protection of our economies and the maintenance of democracy.

Meanwhile, the grand opening of Putin’s Diner is just around the corner.