About a month ago, April 5th to be exact, the Globe and Mail ran a piece about Big Law cuts in response to Covid-19. The article concentrated on the wage rollbacks, noting a few Big Law firms that have cut ‘non-partner salaries’ by 10-15 percent. A concerned Globe reader from Thunder Bay (shout out to Geoff Lee) drolely noted in a letter to the Globe editor, “Lawyers? Cutting salaries? Truly the end is nigh.”

Indeed. Geoffrey’s well-played joke is naturally based on a stereotype of lawyers as pernicious, greedy and self-centered. Obviously, neither the Globe or Geoff are spokesmen for the entire profession, but where there is smoke there is sometimes fire. And a big chunk of the stereotypes about lawyers are likely driven by the average client’s view of Big Law.

This opinion bears some examination.

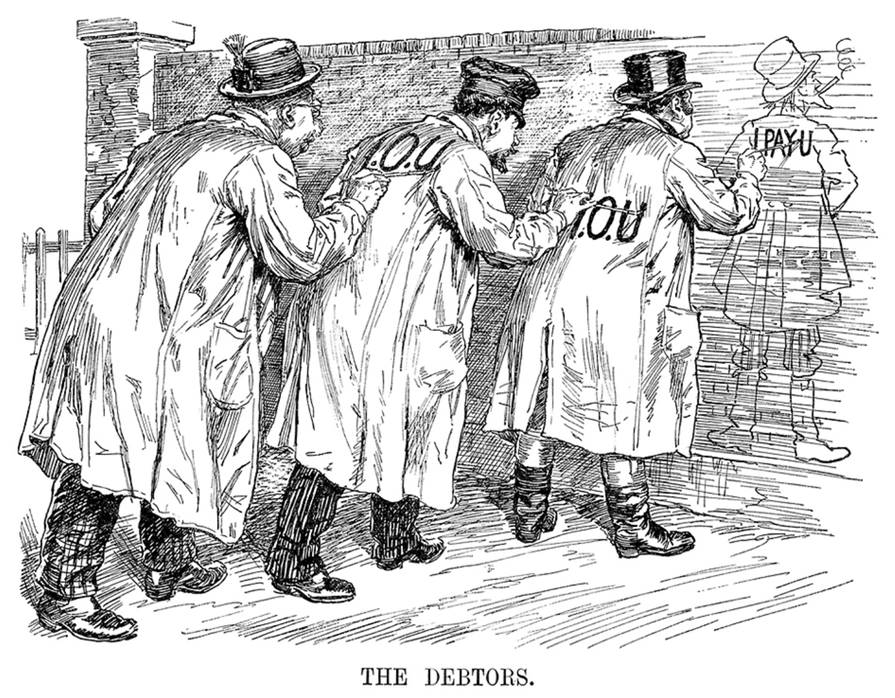

We are in the midst of the Image Credit: Punch Magazine largest economic slowdown of the last century. Covid-19 is bad enough, but Alberta in particular is also subject to the devastating impact of a historic oil price collapse. In the face of this economic pressure, Alberta business will have to innovate to survive. Cutting costs. Going to a total virtual model. Finding export markets. In this rush to survive, there will be no holy cows – and a few cows could well find themselves in a hamburger bun.

And yet, Big Law’s response thus far has not been a radical change of cost structure or drastic rate cuts or offers for fixed fees; but rather associate reductions and employee pay cuts. The savings effected by these measures do not seem to have been passed on to clients. The message is that the Big Law partners will preserve the Big Law model at all costs, and that a reversion to the “good times” will resume as soon as the market permits.

At the very least, this is a tone-deaf message to clients who cannot rest on the promise of “good times” to revert to their favorite model.

The tone-deafness is compounded by the reduction of leadership in other non-law industries.

BDO and KPMG have cut partner draws 25% according to recent reports. Many oil company executives have cut their pay 35-50%. Have Big Law partners proportionately reduced their draws, or do the associate layoffs, wage rollbacks and rent holidays simply make up for lower revenues in a bid to keep partners at the same Profit Per Equity Partner (PPEP)? Clients will never know, but the question does lay bare the undying support of the Big Law model.

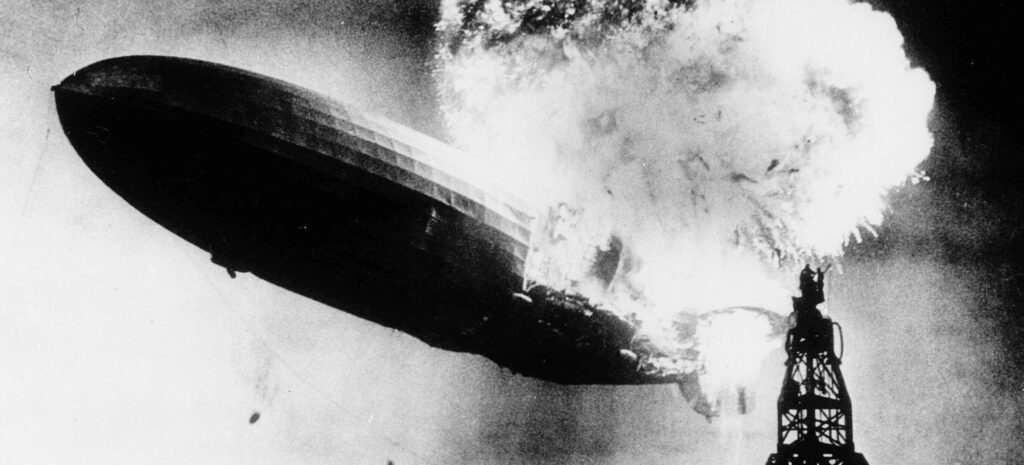

At the very worst, the tone-deaf message evinces a surreal attitude. When are “good times” going to waltz back anyhow? It seems like a dubious thing to base a corporate strategy on. This points to another theme. Big Law partners have, by in large, forgotten that they are entrepreneurs. An annual draw in one year turns into the expectation for the next year. Eventually those expectations turn from a projection of revenue from a common business endeavour to an entitlement to a personal “salary”.

These entitlements pit partners in Big Law against each other in bid to preserve their personal “salary” level. It also puts the growth focus on each partner’s personal return, rather than the growth of the business as a whole. By analogy, each partner in Big Law is a Dairy Queen franchisee, competing with other franchisee partners in the firm to sell ice cream under the firm’s franchise name.

With this system in place, how would Big Law partners be incentivized to act as one; like a real integrated business and not a franchise operation? If they did, they might be able to adapt Big Law to keep pace with their client’s strategic changes to survive Covid-19 and Low Oil Prices? In the meantime, the incentives to do so simply do not exist. With the result that the cuts will be borne mainly by employees to buy time for partners to reap the benefits of the Big Law model in “good times”, once the sun shines again.