Recently, the @UKTories announced a 25% Energy Profits Levy (#UKWindfallTax) on energy producer profits. In a populist move, the resultant £5 billion tax revenue will be deployed to abate high energy prices for UK consumers.

When I heard this news item on @BBCWorldNews, I immediately thought of John Wayne’s famous words: Life is hard, but it’s even harder if you’re stupid.

Although the Windfall Tax has been around since about 1997, and is meant to help ordinary Britons deal with high energy prices in a regulated price environment, the price spike itself is the logical output of the very (goofy) energy policies espoused by the UK Tory Government for years.

I do not believe that the UK Government is generally “stupid”. But the Windfall Tax does demonstrate a shocking, fundamental ignorance of all that drives energy economics and geopolitics (hereinafter Energy Illiteracy). It is the kind of thing that lends a ring to John Wayne’s words. How so, you might ask?

Energy Illiteracy & Reckless Transition (2015-2020)

The initial consensus around the 2015 Paris Accord was to abate carbon emissions through a variety of means, including the key use of Natural Gas as a transition energy source until replacements were technically and economically fit to take over.

But then 2018 to 2020 saw a political push to accelerate the Energy Transition. During the pandemic, many Governments and activists simply declared the end of hydrocarbon use, without comprehending that doing so was not yet technically, economically or even politically feasible. Although scaledalternatives to Natural Gas simply did not yet exist, Energy Illiteracy permitted (and even demanded) these surreal energy policies.

But declaring something does not make it true – no matter how much that declaration is supported by a confirmation-bias.

During this time, the @UKTories were a main driver for this surreal policy; aiming to starve capital for new Natural Gas projects (amongst other things). This set the stage for negative outcomes – globally and in the UK.

Energy Illiteracy & Logical Aftermath

As John Keynes might tell you, the price of a thing usually increases with demand and rarity. And John Wayne would tell you that life will get even harder if you do not understand John Keynes.

But between 2015 and 2020 the @UKTories did not listen to either John – because Energy Illiteracy blinded them to global energy supply-demand fundamentals. By helping starve capital markets for Natural Gas projects (in particular), the Tories signed British citizens up for two certain outcomes:

- A petroleum price spike; and

- A heightened geopolitical exposure from European reliance on Russian gas.

Both of those chickens came home to roost. Cluck Cluck.

As national economies sprung to life post-pandemic, energy prices increased because: (a) more energy was needed (e.g. more demand) and (b) a lack of petroleum / natural gas investment funding from 2015-2020 lead to a lack of reserve replacement (e.g. a rarity). And so prices climbed steadily through Q4 2021 and Q1 2022.

In parallel, an increasingly paranoid and aggressive Putin was geopolitically emboldened by Europe’s reliance on Russian gas. He correctly perceived this reliance to be a hedge on Europe’s appetite to oppose an invasion of the Ukraine. The daily purchase of Russian petroleum by European states is still a wedge to combatting Putin’s murderous ambitions.

And so the @UKTories’ Energy Illiteracy made a hard situation even harder. As bad as that is, the hardship is not even done yet.

Energy Illiteracy & Making Things Worse

Could the @UKTories’ Energy Illiteracy make things harder still? The sad answer is “most certainly”.

At a time when the West desperately needs energy companies (especially Western energy companies) to identify new Natural Gas reserves, the Windfall Tax will ensure that far less UK-company capital will be deployed towards increasing exploration or production. Why? Because that capital that might be used for that purpose will have been scuppered for the Windfall Tax.

In passing, I note that Big Pharma was not hit with a windfall tax on profits during the pandemic. Similarly, there is no windfall tax on power producers at a time when megawatt hour prices are spiking too. Both of which feel … awkward.

The @UKTories’ energy policy will continue to limit Natural Gas reserve replacement, thereby helping to ensure that:

- high prices will continue for longer; and

- reliance on Russian hydrocarbons will continue for longer, as non-Russian sources are less available.

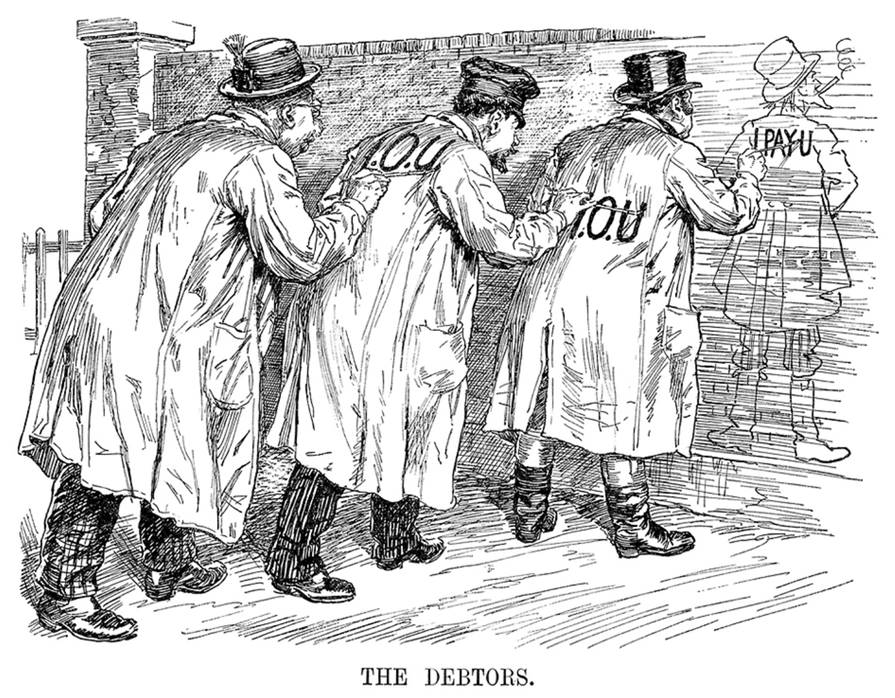

Basically, the @UKTories’ are doubling down on their mistakes – a failure of reason based on Energy Illiteracy.

For those who might feel that we are being too hard on @UKTories, these same mistakes are the motus operandi of many other political actors. There simply is not enough room on this post to list them all (although the Canadian Federal Liberals do deserve a special shout out).

Instead, we point to the dangers Energy Illiteracy poses to global peace, destructive geopolitics, economic growth and social stability. It is everyone’s duty to one another, and to our nations, to make sure we do better – – or even to just require politicians to try do so.